‘Netflix’ เป็นแพลตฟอร์มสตรีมมิ่งที่ใหญ่ที่สุดในโลกอย่างที่เรารู้จัก ล่าสุดมีการเปิดเผยผลประกอบการรายไตรมาสล่าสุด ไตรมาส 4 ปี 2563 ดีเกินคาดในหลายรายการ ไม่ว่าจะเป็นรายได้ จำนวนสมาชิก กำไรต่อหุ้น (EPS) ล้วนมาจากปัจจัยที่เปลี่ยนแปลงพฤติกรรมผู้บริโภค ความไม่แน่นอนดังกล่าวทำให้โลกต้องบังคับใช้มาตรการล็อกดาวน์ทั่วประเทศ มาตรการกักกันและการทำงานจากที่บ้าน (WFH) ในพื้นที่ที่มีความเสี่ยงสูงต่อการแพร่เชื้อโควิด-19 ขั้นรุนแรง

10 อันดับหนัง netflix วันนี้ ตัวอย่างเช่น EPS ของ Netflix อยู่ที่ 1.19 ดอลลาร์ ซึ่งไม่ไกลจากประมาณการของนักวิเคราะห์ (คาดว่าจะอยู่ที่ประมาณ 1.39 ดอลลาร์) แต่นี่ก็ยังคงเป็นระดับความผันผวนที่ไม่น่าตกใจ

10 อันดับหนัง netflix วันนี้ รายรับสำหรับไตรมาสสุดท้ายของปี 2023 อยู่ที่ 6.64 พันล้านดอลลาร์ (จากการคาดการณ์ที่ 6.62 พันล้านดอลลาร์) Reed Hastings ซีอีโอของ Netflix ยังกล่าวอีกว่า “เราคาดว่ากระแสเงินสดที่เป็นบวกจะดำเนินต่อไป” ผลประกอบการไตรมาสที่ 4 ปี 2563 ดีเกินคาด และน่าดึงดูดจาก ‘ใกล้มาก’ ถึง ‘ไตรมาสหน้า’ ซึ่งหมายความว่าการเติบโตของสมาชิก Netflix ในไตรมาสที่ 4 ดีกว่าที่คาดไว้ (6.47 ล้านราย) เทียบกับ 8.5 ล้านรายในปี 2560 การเติบโตของสมาชิกทั้งหมดในปี 2020 อยู่ที่ 200 ล้านราย ซึ่งรวมถึง Netflix Originals และเนื้อหาอื่นๆ จากทั่วโลก

สำหรับใครก็ตาม 10 อันดับหนัง netflix ที่มักจะใช้เวลาเลื่อนดูตัวอย่างภาพยนตร์เป็นจำนวนมากจนกว่าจะเจอสิ่งที่ชอบ ครั้งนี้เราลองเลือกหนังที่ดีที่สุด 20 เรื่องที่พร้อมจะแนะนำ เพราะคุณชอบหนังแอคชั่น คอมเมดี้ หรือละคร? มีภาพยนตร์ดีๆ บางเรื่องในรายการนี้ที่คุณต้องดู

The Bird Box สร้างจากนวนิยายชื่อเดียวกันของ George Mallerman บอกเล่าเรื่องราวแห่งอนาคตอันใกล้นี้ เมื่อโลกของเราเผชิญภาวะฉุกเฉินของการฆ่าตัวตายอย่างไร้สาเหตุ ผู้รอดชีวิตรู้ดีว่าถ้าเขามองดู “มัน” สักครู่ก็จะหมายถึงจุดจบที่โหดร้ายและคาดไม่ถึง ไม่มีใครรู้ว่า “มัน” คืออะไร มาจากไหน และมีวัตถุประสงค์อะไร พลังของภาพยนตร์ (และนิยาย) มาจากการทำให้ผู้ชมตื่นเต้นจนไม่ตระหนักถึงอันตรายที่รออยู่ข้างหน้า จุดประสงค์ของมันคืออะไร? แต่หนังเรื่องนี้ก็มีเงื่อนไขอยู่บ้าง จะเกิดอะไรขึ้นกับตัวละครในเรื่องหากไม่ปฏิบัติตาม “ข้อห้าม” อย่างที่ผู้ชมเห็น? 10 อันดับ หนัง netflix วัน นี้

Excerpt เป็นแอ็คชั่นระทึกขวัญเกี่ยวกับทหารรับจ้างชาวออสเตรเลีย Tyler Rake ทหารอิสระมากทักษะที่มีประวัติอันเจ็บปวดในการซ่อนตัว ได้รับภารกิจจับตัว โอวี มหาจัน บุตรชายของเจ้าพ่อค้ายาชื่อดังของอินเดียที่ถูกศัตรูคู่แข่งลักพาตัวไป ทำทุกอย่างเพื่อให้ได้เขากลับมา ภารกิจความเป็นหรือความตายไม่เป็นไปตามที่คาดไว้ เขาพบว่าตัวเองถูกทรยศบนเส้นทางอันตรายผ่านการต่อสู้และการล่าสัตว์ไปพร้อมกับช่วยเหลือเด็กๆ ภารกิจนี้จะจบลงอย่างไร? 10 อันดับหนัง netflix วันนี้2023

หนังเรื่องนี้ไม่มีหนังแนวแก๊งสเตอร์เยอะ หมวดหมู่เนื้อหาต่ำๆ อาจไม่สะท้อนถึงคุณภาพของหนัง ปีนี้หนังมาเฟียฟอร์มยักษ์ออกโรงหลายเรื่อง หนังเรื่อง The Irishman ของมาร์ติน สกอร์เซซี ที่บอกเล่าเรื่องราวของพวกอันธพาลในอเมริกา และการหายตัวไปอย่างลึกลับของจิมมี่ ฮอฟฟา หลังสงครามโลกครั้งที่ 2 นับเป็นครั้งที่สองจากยุคที่สร้างภาพยนตร์ เรื่องนี้ เล่าเรื่องราวชีวิตทั้งชีวิตของแฟรงค์นอกเหนือจากคนดัง 10อันดับหนังnetflix

6 Underground แอ็คชั่นคอมเมดี้เกี่ยวกับโลกที่ถึงเวลาที่ผู้คนจะต้องช่วยเหลือซึ่งกันและกัน เรื่องราวของเศรษฐี 6 คนเริ่มต้นจากผู้นำคนเดียว เขาไม่สามารถมองเห็นสภาวะของโลกอีกต่อไป พวกเขาจึงสร้างเรื่องราวร่วมกัน ขอให้พวกคุณทั้ง 6 คนตายและเกิดใหม่เป็นฮีโร่ใต้ดิน ไม่มีชื่อในโลกนี้ในการช่วยเหลือผู้อื่นและขจัดอาชญากรรม พวกเขาโทรด้วยตัวเลขเท่านั้น

เรื่องย่อ: พวกเขาคือคนที่ไม่สามารถทนต่อความอยุติธรรมในโลกนี้ได้ เมื่อคนชั่วร้ายจริงๆ กฎหมายไม่สามารถลงโทษพวกเขาได้ ตายจากโลกนี้และเกิดใหม่เป็นฮีโร่ใต้ดินที่แสดงด้วยตัวเลข เพื่อกำจัดสิ่งชั่วร้ายในโลกนี้ ภาพยนตร์ของ Netflix เรื่องนี้ได้รับความสนใจนับตั้งแต่มีการประกาศทีมผู้ผลิต เริ่มจากมิสเตอร์เดดพูลกันก่อน ไรอัน เรย์โนลด์ส นักแสดงนำของภาพยนตร์เรื่องนี้เข้าร่วมโปรเจ็กต์นี้ซึ่งเป็นประโยชน์ต่อ Netflix ด้วยการกำกับและการแสดงที่ยอดเยี่ยมของเขา โดยไม่สนใจโครงเรื่องมากนัก การแสดงอันน่าทึ่งของไมเคิล เบย์ ครองอันดับ 1 บ็อกซ์ออฟฟิศได้อย่างง่ายดายด้วยงบประมาณที่จำกัด มูลค่ากว่า 150 ล้านเหรียญสหรัฐ (หากเข้าฉายในโรงภาพยนตร์) และนำมาสู่บริการสตรีมมิ่งเพื่อแสดง เห็นว่า 10อันดับnetflix เป็นมากกว่าบริการดูหนังออนไลน์ แต่มันเป็นสตูดิโอภาพยนตร์ที่ใหญ่และทรงพลัง เช่นเดียวกับสตูดิโอขนาดใหญ่อื่นๆ

Spenser Confidential สเปนเซอร์ ตำรวจผู้ทนต่อความอยุติธรรมไม่ได้ มักจะเข้าไปยุ่งเรื่องของคนอื่นเพื่อให้ดูแลตัวเองและไม่เคยอยู่ต่อหน้าใครและความดุร้ายของเขามักสร้างเรื่องราวการต้องต่อสู้กับผู้อื่นอยู่เสมอ เจ้าหน้าที่ตำรวจคนหนึ่งถูกทุบตีอย่างรุนแรงจนต้องติดคุกด้วยซ้ำ

เมื่อผู้กำกับภาพยนตร์ชื่อดังมาทำงานที่ Netflix เราพอจะสรุปได้ว่าเป็นเพราะเหตุผล 3 ประการ ประการแรก เป็นโปรเจ็กต์ที่สตูดิโอภาพยนตร์รายใหญ่ไม่สนใจทำ หรืออย่างที่สองคือโปรเจ็กต์ที่ผู้กำกับอยากลองทำอะไรสักอย่าง บรรยากาศใหม่ๆ อย่างที่สาม การได้ร่วมงานกับมาร์ค วอห์ลเบิร์ก ไม่ใช่เรื่องยาก (555) พวกเขากลายเป็นคู่รักใหม่ในเรื่องจริงอย่าง Lone Survivor (2013) และ Patriots Day (2016) เชื่อกันว่าทั้งคู่มารวมตัวกันโดยพิจารณาจากผลงานเป็น งาน Netflix สภาพแวดล้อมแตกต่างออกไปเพราะนอกเหนือจากสภาพแวดล้อมการทำงานที่สร้างโดย Netflix แทนที่จะเป็นสตูดิโอภาพยนตร์แล้ว สถานที่ตั้งของภาพยนตร์เรื่องนี้ยังเป็นการดัดแปลงจากนวนิยายชุดชื่อดังของ Robert B. Parker ผู้เขียนชื่อดังซึ่งสืบสวนการทุจริตในกองกำลังตำรวจ ตัวละครหลักคือ Spencer ซึ่งเคยปรากฏในละครทีวีเรื่อง Spencer 1985: Let’s Rent and Change เป็นหนังแอ็คชั่นคอมเมดี้ด้วย

Enola Holmes พูดถึงนักสืบชื่อดังระดับโลก “Sherlock Holmes” เป็นนวนิยายนักสืบของอังกฤษ เรื่องราวนักสืบที่ใช้วิธีการอันชาญฉลาด บุคลิกประหลาดของเขาดึงดูดผู้อ่านจำนวนมาก แต่ใครจะเชื่อนักสืบมืดคนนี้? เขายังมีพี่น้อง ภาพยนตร์เรื่องนี้แนะนำให้คุณรู้จักกับสมาชิกคนหนึ่งของครอบครัวโฮล์มส์ น้องสาวของเขาและอิโนลา โฮล์มส์

Murder Mystery เป็นเรื่องราวของ Nick และ Audrey คู่รักที่ห่างเหินกันมานานซึ่งทำงานเป็นเจ้าหน้าที่ตำรวจในนิวยอร์ก ออเดรย์เป็นช่างทำผม ทั้งสองตัดสินใจไปยุโรปเพื่อฮันนีมูน ขณะเดินทางบนเครื่องบิน ออเดรย์ได้พบกับสาวสังคมชื่อคาเวนดิช พวกเขาไปงานปาร์ตี้บนเรือยอทช์ของมหาเศรษฐีมัลคอล์ม ควินซ์ แต่ในระหว่างงานเกิดไฟฟ้าดับอย่างไม่คาดคิด มัลคอล์มเสียชีวิตทันทีที่แสงสว่างสว่างขึ้น โชคร้ายเกิดขึ้นกับนิคและออเดรย์ สงสัยเป็นแขก.

ในอนาคตสวีเดนจะทำให้เกิดสงครามครั้งใหญ่และทั้งประเทศจะล่มสลาย Black Crab ผู้คนหิวโหยและแห้งแล้ง และมันทำให้เกิดวิกฤติทุกที่ แต่แล้ววันหนึ่งทหารหญิงได้รับมอบหมายให้ส่งพัสดุลึกลับซึ่งหวังว่าจะหยุดยั้งสงครามครั้งนี้ได้เป็นหนังสงครามไซไฟที่มีฉากอยู่ในโลกที่ล่มสลายซึ่งมีฉากอยู่ในทะเลน้ำแข็งที่แปลกประหลาด กว้างใหญ่ สวยงามและน่าสะพรึงกลัว .ฉากเนื้อเรื่องและฉากต่อสู้น้ำแข็งทำได้ดีมากพร้อมๆ กับจุดเริ่มต้น และเนื้อเรื่องต่าง ๆ ต่อเนื่องกันไม่มีสะดุดและเป็นคำตอบที่ตอบโจทย์แฟนหนังสงครามได้อย่างแน่นอน นอกจากนี้ นูมิ ราเพซ ยังออกมาโชว์ลีลาพระเอกสาวมากความสามารถอีกด้วย ฉากถ่ายทำทุกฉากสนุกสนานและน่าตื่นเต้นและมีความลับให้ติดตามธีมของเรื่อง นอกจากนี้เรื่องราวความรักของแม่ยังถูกแทรกเข้าไปในหัวใจของเรื่องอีกด้วย

ภาพยนตร์ Netflix ของสวีเดนโดยทั่วไปไม่น่าสนใจในประเทศของเรา ภาพยนตร์ยุโรปที่ไม่ใช่ภาษาอังกฤษไม่ค่อยได้รับความนิยมในหมู่ผู้ชื่นชอบภาพยนตร์ในประเทศของเรา นอกจากนี้ ดาราอย่าง Noomi Rapace ซึ่งได้รับความนิยมในภาพยนตร์ต้นฉบับของสวีเดนเรื่อง ‘The Girl with the Dragon Tattoo’ ก็เคยลองเช่นกัน ผู้ชมภาพยนตร์และโอกาสในการแสดงในภาพยนตร์ฮอลลีวูดชื่อดังหลายเรื่อง

ยอมรับว่านี่คือภาพยนตร์แบบครอสโอเวอร์ การเปลี่ยนผ่านจากละครเพื่อนร่วมโดยสารไปสู่ความรุนแรงทางการทหารที่จำเป็นในสงคราม ภารกิจไม่ได้เกี่ยวกับการไล่ตามความฝันหรือการเรียนรู้เกี่ยวกับชีวิต แต่มันเป็นชัยชนะในสงคราม ในรูปแบบคลาสสิก Empty ให้ความรู้สึกเหมือนหนังสงครามเกี่ยวกับการเข้าสู่ดินแดนของศัตรู เช่น Saving Private Ryan (1998) แต่เป็นกลิ่นหอมที่น่าดึงดูดและน่าดึงดูดอย่างชาญฉลาด

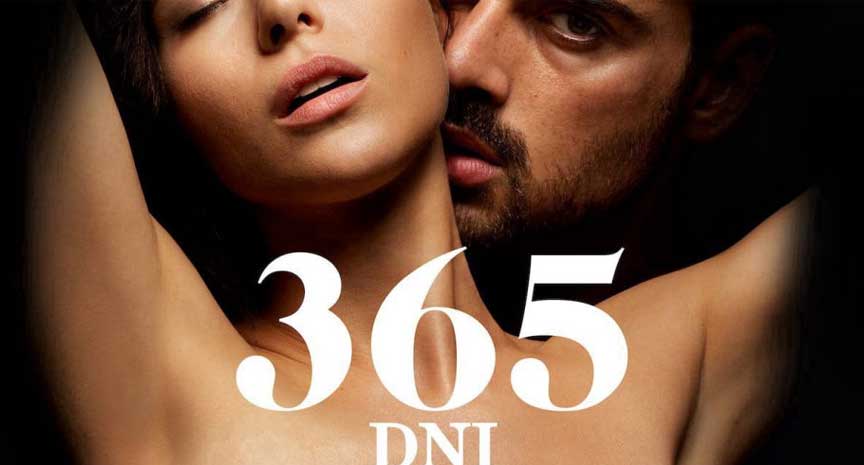

เรื่องราวของ 365Days ติดตาม Massimo (Michel Morone) มาฟิโอโซหนุ่มหล่อ เขามีหนวดเคราเป็นพวงและมีกล้ามเนื้อที่พระเจ้าประทานให้ แม้แต่ผู้ชายก็ควรเคารพเท้าของตนเอง แต่โชคชะตากลับเห็นนักธุรกิจสาวสุดฮอต ลอร่า (แอนนา มาเรีย ซิกลากา) ระหว่างเดินทางไปสนามบินกับมัสซิโม พ่อของเขา จนกระทั่งเกิดเหตุการณ์ไม่คาดฝันขึ้น และพ่อของมัสซิโมก็เสียชีวิตและบาดเจ็บสาหัสต่อหน้าต่อตาคุณ ขณะที่เขากำลังพักฟื้น ลอร่าคือผู้หญิงในฝันของเขา

ย้อนเวลากลับไปตามหาอดัม หลังจากยานอวกาศตกในปี 2022 อดัม รีด นักบินรบข้ามเวลาได้ร่วมมือกับเด็กอายุ 12 ปีในภารกิจกอบกู้อนาคต แนวคิดหลักของ ‘The Adam Project‘ คือเราจะว่าอย่างไรหากเราสามารถกลับไปพูดคุยกับเยาวชนของเราได้? การออกแบบตัวละครของอดัมชนะใจผู้ชม และไม่ผิดที่จะเรียกเขาว่าผู้แพ้ เขายังเป็นขี้แพ้ที่ยืนกรานถึงตัวตนในอนาคตของเขา เขามีแฟนสาวแสนสวย แต่เขาต้องตามหาเธอให้เจอหลังจากที่เขาจากพ่อไปเมื่ออายุ 12 ปี

ภาพยนตร์ของ Netflix เรื่องนี้ได้รับความสนใจนับตั้งแต่มีการประกาศทีมผู้ผลิต 10 อันดับหนัง netflix วันนี้ เริ่มด้วยมิสเตอร์เดดพูล ไรอัน เรย์โนลด์สเข้าร่วมโปรเจ็กต์นี้ ซึ่งให้รางวัล Netflix ด้วยผู้กำกับที่แข็งแกร่งและนักแสดงที่ยอดเยี่ยมของไมเคิล และเป็นนักแสดงนำเพียงคนเดียวของภาพยนตร์เรื่องนี้ที่ไม่สำคัญกับโครงเรื่องมากนัก Netflix ติดอันดับบ็อกซ์ออฟฟิศชาร์ต (หากเข้าฉายในโรงภาพยนตร์) และบริการสตรีมมิ่งเพื่อแสดงให้เห็นว่าเป็นมากกว่าบริการดูภาพยนตร์ออนไลน์ แต่เป็นสตูดิโอภาพยนตร์ที่ใหญ่และทรงพลัง เช่นเดียวกับสตูดิโอขนาดใหญ่อื่นๆ

ปิดท้ายด้วย 10 ภาพยนตร์ชื่อดังจาก Netflix แล้วคุณล่ะ? ทุกคนชอบอะไรเป็นพิเศษมั้ย? คุณสามารถติดตามฟีดข่าวต่างๆ หากคุณต้องการให้คะแนนปัญหาต่างๆ คุณสามารถทำได้

What’s on Netflix ได้สรุปสถิติคอนเทนต์ทั้งหมดที่ได้รับกระแสตอบรับที่ดี ตั้งแต่ที่เปิดตัวจนถึงเดือน ม.ค. 2021 ทั้งที่เป็นคอนเทนต์ของ Netflix (Netflix Originals) และคอนเทนต์อื่นจากทั่วโลก

What’s on Netflix ได้สรุปสถิติคอนเทนต์ทั้งหมดที่ได้รับกระแสตอบรับที่ดี ตั้งแต่ที่เปิดตัวจนถึงเดือน ม.ค. 2021 ทั้งที่เป็นคอนเทนต์ของ Netflix (Netflix Originals) และคอนเทนต์อื่นจากทั่วโลก